Transitions: Key moments for veteran’s financial health

Veterans and their families are no strangers to major changes—from frequent moves and deployments to separating from the military, starting new careers and adapting to changes in their families. While there can be much to look forward to and plan for, people often neglect one critical component: adjustments to their financial planning.

But as one expert cautions, transitions are the precise time veterans need to hone in on their financial planning.

Working toward your goals

“Whenever you transition, you need to have a why behind your transition,” said Chief Warrant Officer of the Army Reserve Russell Simmons, MBA, CERTIFIED FINANCIAL PLANNER™ (CFP®).

Simmons recently shared his insights for veterans as part of the Veterans Financial Preparedness Report 2019, which was prepared by the Legionnaire Insurance Trust for the departments of The American Legion to celebrate the organization’s 100th anniversary. “You always need to keep those whys—those goals—in mind,” he said.

As an example, Simmons said one of his goals when he joined the military 16 years ago was getting help paying for college. Several years after enlisting, he transitioned to a warrant officer in the engineering branch of the Army Reserve. During that time, he took advantage of the Post 9/11 GI Bill, which paid for all but $5,000 of his bachelor’s and master’s degrees.

“Sometimes you’re just focused on what’s next during a transition,” Simmons said. But a transition period is when veterans also need to look further ahead to the goals they will be working toward in this new phase. That’s where a written financial plan becomes especially important.

Regardless of how much—or how little—money they have, veterans need a plan that keeps them focused on the big picture of where they want to go. The plan should encompass their entire financial situation to address their concerns, achieve their goals and prepare them well for retirement.

“A financial plan should include what retirement looks like for you and outline things like how you will invest and whether you will be receiving a pension or disability check,” Simmons said. “It can also help you identify needs for insurance and estate planning to protect you and your family.”

A living financial plan

Many people who have established a financial plan go wrong by thinking of it as one-and-done, a reference document to file away. But veterans’ financial plans should grow and change with them.

“A financial plan is always specific to the time that you created it,” Simmons said. “After you’ve created your financial plan, you should revisit your goals for retirement at least annually. You should also revisit your plan if you’ve had a major life change, such as separation from the military, birth of a child, marriage, divorce or death of a loved one.”

Simmons points to life insurance as a good example. Service members could carry up to $500,000 in life insurance, but when they separate from the military, that coverage ends.

“It’s not a portable policy, so you need to talk to an agent before you get out to ensure you have continued coverage,” Simmons said. “Life insurance is a really good component [of your financial plan], especially if you have a spouse or children who are dependent on you.”

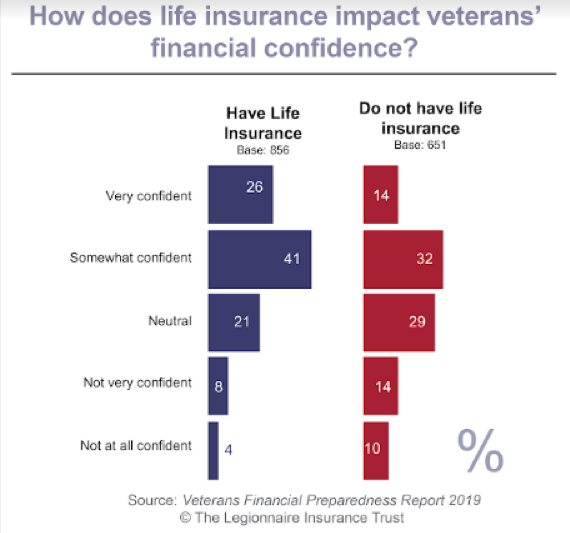

Many veterans fail to secure life insurance once they’ve transitioned to civilian life. According to the Veterans Financial Preparedness Report 2019, 75% of veterans who are ahead in saving for retirement have life insurance, versus just 44% of those who are behind. Those who have life insurance are much more likely to say they are confident they are making the best financial decisions for their family.

Planning ahead for the next phase can be critical for veterans to achieve their long-term goals.

New transition, new resources

“Make sure to know and leverage all of your resources as you go to your next life change,” Simmons said. “That may be the only time that you have to commit to understanding those resources available to you.”

Investing the time to research specific benefits and opportunities can really pay off because some apply specifically to certain transitions.

Among the resources Simmons recommends exploring are free resources at local military bases, the military’s Transition Assistance Program, home loans and other options through the VA, resources with veteran organizations, and opportunities with local financial advisor networks and nonprofits that focus on helping service members and veterans (such as the Financial Planning Association Pro Bono Day events and free activities offered through the Foundation for Financial Planning).

The Veterans Financial Preparedness Report 2019 also features additional advice from Simmons and insights from 1,507 veterans. The report includes key findings about veterans’ financial situations and shares 5 attributes of veterans who are financially prepared.

Read Articles

• How do you compare? 5 traits of financially prepared veterans

• Veterans share 6 top insights for financial preparedness

• Transitions: The key moments for veteran’s financial health

• Behind for retirement? How veterans can get on-track (Part 1)

• Behind for retirement? How veterans can get on-track (Part 2)